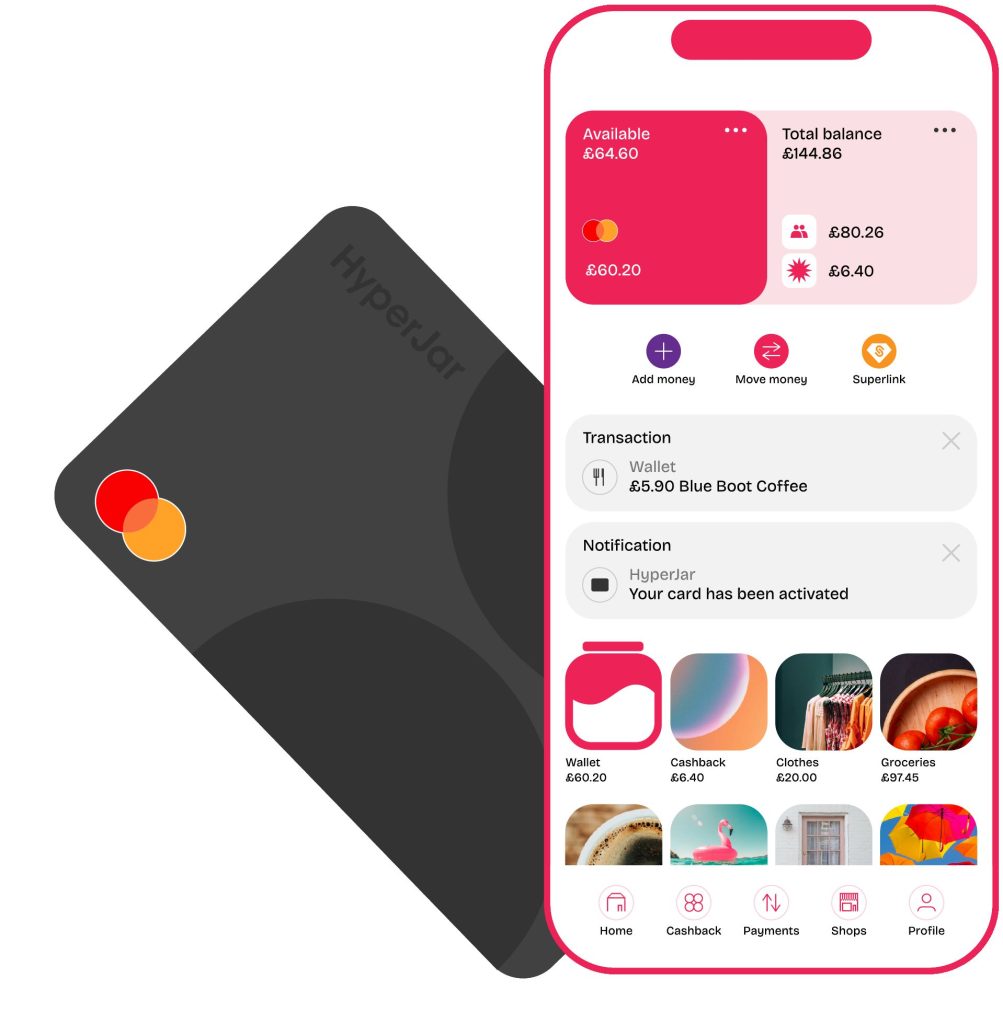

HyperJar is a UK-based financial service that offers a free prepaid debit Mastercard connected to a personal account managed entirely through its app. Instead of relying on a traditional current account or credit line, HyperJar provides an e-money solution where users load funds themselves and manage spending through a system of digital “jars.”

It is designed for individuals and families who want better control over their daily expenses, shared budgets, and group savings. The purpose of this article is to provide a full analysis of the HyperJar debit card, exploring its main features, benefits, potential drawbacks, and the process of requesting one. By the end, you will know whether this prepaid solution suits your financial needs.

Main features of HyperJar debit card

The HyperJar card is a prepaid debit product that works on the Mastercard network. This means you can only spend the money you have previously loaded, avoiding the risk of debt or overdraft. A major advantage is that the card is issued free of charge, and HyperJar emphasizes no extra fees on international purchases, making it appealing for both domestic and foreign use.

Approval requirements

Since it is prepaid, HyperJar does not operate like a credit card and does not require a minimum income level or a credit score check. The sign-up process involves identity verification, as required by regulation, but there is no formal credit analysis. This makes it accessible to a wide audience, including people who might not qualify for traditional credit cards, as well as parents looking to introduce financial independence to their children in a safe way.

Benefits of HyperJar debit card

One of the main attractions of HyperJar is its digital jars system, which allows users to allocate funds visually across different categories, such as groceries, bills, holidays, or personal savings. These jars can also be shared with friends or family, simplifying group budgeting, bill splitting, and collective savings goals. The visual organization of funds helps users track their money in real time.

Standout highlight

The combination of shared jars, cashback rewards, and fee-free international usage is what makes HyperJar stand out in the prepaid debit card market. This mix of features is rare for a free product and makes the card especially useful for family budgeting and group travel.

Disadvantages and watch-outs of HyperJar debit card

The biggest limitation is that the HyperJar card is not a credit product. As a result, it does not help users build credit history and does not offer premium benefits associated with higher-tier credit cards, such as airport lounge access, comprehensive travel insurance, or airline miles. Users looking for these features may need to consider complementary credit card options.

How to apply step by step

The process to obtain a HyperJar debit card is simple and fully digital. First, you download the HyperJar app from your smartphone’s app store. After installing, you sign up, go through the standard verification process, and order your card—choosing between a virtual version or a physical card. Once your account is active, you load funds directly from your bank and start creating jars for different spending categories or shared goals. Finally, you can integrate your card into Apple Pay or Google Pay for convenient mobile payments.

Who is HyperJar debit card ideal for?

HyperJar is particularly well-suited for budget-conscious individuals and families who want greater control over their spending. Parents, for example, find it useful for teaching children how to manage money responsibly, since they can allocate allowances into jars, set limits, and monitor usage in real time.

It is equally attractive for travelers and online shoppers, given the absence of foreign transaction fees and the availability of discounts with partner merchants. However, those seeking to accumulate points, miles, or premium lifestyle perks may find a credit card more aligned with their needs.