Managing debt effectively is crucial, especially when it comes to high-interest credit card balances. Tesco Bank offers a solid solution with its Clubcard Credit Card for Balance Transfers, designed to help customers consolidate their debts and pay them off more efficiently.

By offering an impressive 27-month interest-free period on balance transfers, this card stands out as a valuable tool for those seeking relief from interest payments. In this article, we’ll explore the key aspects of this card, its advantages, and how to apply.

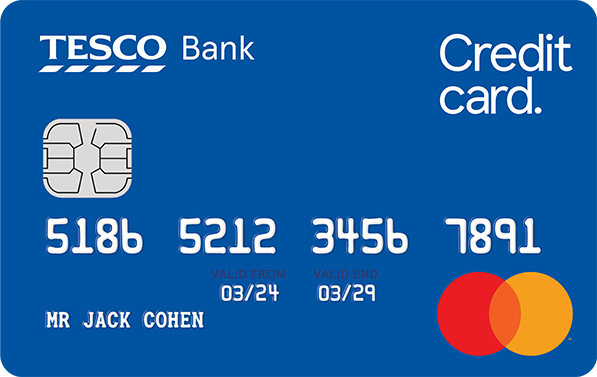

Key information about the credit card

How does the annual fee work?

Interestingly, the Tesco Bank Clubcard Credit Card for Balance Transfers does not carry an annual fee. This is a significant advantage, particularly for those who are primarily focused on consolidating debt. Many other balance transfer cards on the market charge an annual fee, making this card a more appealing option for consumers who want to avoid additional costs. The lack of an annual fee also means that the money saved can be put toward reducing your debt even faster, making it a highly cost-effective option.

How is the credit limit determined?

The credit limit on the Tesco Bank Clubcard Credit Card for Balance Transfers is determined based on several factors related to your financial profile. Like most credit cards, Tesco Bank reviews the applicant’s income, credit score, and current financial obligations to assess creditworthiness.

The better your credit score and financial standing, the higher the potential credit limit you may be approved for. On average, applicants can expect a limit around £1,200, although this may vary.

Advantages of the credit card

- 27-month 0% interest on balance transfers: This extended period provides significant breathing room to pay off debts without accruing interest.

- No annual fee: As mentioned, the absence of an annual fee adds to the card’s appeal, especially for those focused on saving money.

- 0% interest on money transfers: For the first nine months, cardholders can enjoy 0% interest when transferring money to a bank account, making it easier to cover urgent expenses without high fees.

- Clubcard points: Earn points on almost every purchase, redeemable at Tesco and partner stores, enhancing the card’s value for everyday shopping.

- Mobile banking convenience: Tesco Bank’s mobile app makes it easy to manage your finances on the go, including tracking purchases and monitoring your balance transfer progress.

Standout advantage

One of the standout features of the Tesco Bank Clubcard Credit Card for Balance Transfers is undoubtedly the 27-month interest-free period on balance transfers. This lengthy duration allows cardholders to focus on paying down their debt without the immediate pressure of interest payments.

Whether you’re consolidating multiple credit card balances or transferring store card debts, having over two years of 0% interest creates a rare opportunity to make significant progress in eliminating debt.

Disadvantages

- Balance transfer fee: Although the 0% interest period is generous, the 2.95% fee on balance transfers may add up if you are transferring a large balance.

- Limited money transfer interest period: The 0% interest on money transfers only lasts nine months, which might not be enough time for some users to pay back what they owe without interest.

- Post-promotion interest rate: After the promotional period ends, the card’s APR is relatively high, which may negate some of the benefits if you haven’t paid off your balance.

A standout disadvantage

The main downside of the Tesco Bank Clubcard Credit Card for Balance Transfers is the relatively high APR once the promotional 0% interest period ends. At 24.9% APR (variable), cardholders who haven’t paid off their balances within the 27-month window may find themselves facing steep interest rates.

This makes it crucial to have a solid repayment plan in place to maximize the benefits of the interest-free period and avoid being hit with substantial interest charges after the promotion ends.

Who can apply for this card?

To apply for the Tesco Bank Clubcard Credit Card for Balance Transfers, applicants must meet certain eligibility criteria. First, you must be a UK resident and at least 18 years old. Tesco Bank will also conduct a credit check, so having a decent credit score is important for approval.

Additionally, applicants will need to provide proof of income to ensure they can handle the monthly repayments. While Tesco Bank does not publicly disclose a specific minimum income requirement, they do look for a stable financial history.

The card is not designed for individuals with poor credit, so it is unlikely to be available to those with a damaged credit score or those who are currently in financial difficulty. Lastly, you will need to complete the balance transfer within 90 days of opening your account to take advantage of the 0% interest offer.

How to apply for the Tesco Bank Clubcard Credit Card for Balance Transfers

For the website

Applying online is the most convenient option for many users. To begin, visit the Tesco Bank website and navigate to the credit card section, where you’ll find the Clubcard Credit Card for Balance Transfers. The application process typically takes around 10 minutes and requires you to input details such as your name, address, employment status, and income.

You’ll also need to provide information about any existing credit card debts you wish to transfer. After submitting your application, Tesco Bank will perform a credit check. If successful, you’ll receive immediate confirmation, and the balance transfer can be initiated shortly thereafter.

Through the app

For those who prefer mobile convenience, the Tesco Bank app provides a streamlined way to apply for the Clubcard Credit Card for Balance Transfers. The process is similar to the online application, but with the added benefit of being able to manage your entire account via your smartphone once approved.

Simply download the app from the App Store or Google Play, log in or create an account, and follow the steps to apply. The app also allows you to track the progress of your application and, once approved, you can start managing your card right from your phone.

At the branch

Finally, for individuals who prefer a more personal touch, Tesco Bank offers the option to apply in-store. Visit your local Tesco branch, where a customer service representative can guide you through the application process.

While this may take a little longer than applying online or via the app, it’s a good option if you have specific questions or concerns about the card or application. Once the application is completed in-store, it will be submitted for review, and you can expect to hear back within a few days.