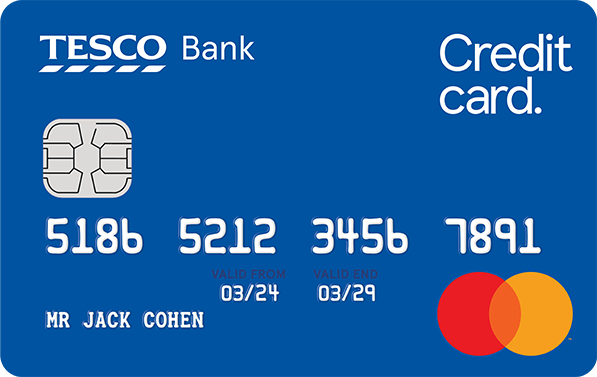

If you’re looking for a strategic way to reorganize your finances, the Tesco Bank Credit Card for Balance Transfers may be an excellent choice. Issued by Tesco Bank and backed by the Visa network, this card is designed specifically for individuals who want to save on interest by consolidating existing credit card debt under a 0% interest rate offer.

In this article, you’ll find a comprehensive analysis of this credit card — including its benefits, drawbacks, how to apply, and who it’s best suited for. Read on to discover if it’s the right financial tool for your needs.

Key features of the Tesco Bank Credit Card for Balance Transfers

The Tesco Bank Credit Card for Balance Transfers is considered a basic card, but it delivers robust advantages for those needing financial flexibility. It operates on the Visa network, which guarantees wide acceptance both in the UK and abroad. While there is no clear mention of an annual fee, the focus is on the promotional interest rates: 0% interest on balance transfers for 32 months (with a 3.19% transfer fee), and 0% interest on money transfers to your bank account for 9 months (with a 3.99% fee).

Eligibility requirements

There’s no minimum income requirement explicitly listed, but applicants must be at least 18 years old and UK residents. A credit check will be conducted, so your credit history (via Experian, Equifax, or similar agencies) will be considered during the approval process. The ideal applicant has a stable financial background and a good to excellent credit score. This card is perfect for those looking to manage existing debt rather than earn luxury benefits or travel perks.

Benefits of the Tesco Bank Credit Card

The standout feature of this card is the 32-month 0% interest period for balance transfers, one of the longest offers available in the UK market. For individuals dealing with high-interest credit card debt, this window provides significant breathing room to pay down balances without incurring extra costs. Additionally, users benefit from 0% interest for 9 months on money transfers, allowing them to move funds directly to their bank account.

Unique highlight

What makes this card truly unique is the guaranteed 32-month interest-free period on balance transfers, a feature that few competitors can match. The ability to transfer nearly your full credit limit (up to 95%) at this promotional rate adds to its appeal for debt consolidation strategies.

Drawbacks and things to consider about the Tesco Bank Credit Card

Despite its attractive features, the card has a few drawbacks. The transfer fees — 3.19% for balance transfers and 3.99% for money transfers — may offset some of the benefits, especially for larger amounts. Over time, these costs can accumulate if not properly planned. Another concern is the high purchase interest rate, which can range from 24.9% to 29.9% APR (variable), depending on your individual financial profile.

How to apply

Applying for the Tesco Bank Credit Card for Balance Transfers is straightforward and can be completed online in around 10 minutes. The process includes filling out a form with your personal and financial details, followed by a standard credit check. Tesco Bank also offers an eligibility checker that allows you to verify your chances of approval without impacting your credit score — a helpful tool if you’re comparing multiple credit card offers.

Who is the Tesco Bank Credit Card for Balance Transfers ideal for?

This card is best suited for consumers who want to save money on interest while paying off existing debt. The long 0% interest window and flexible credit limit use make it a powerful tool for debt management and financial recovery. However, if you’re looking for luxury perks, travel rewards, or extensive partner discounts, this might not be the ideal card.