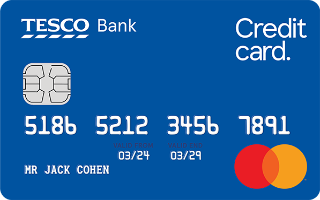

The Tesco Clubcard Plus Credit Card is designed for customers who are already part of Tesco’s Clubcard Plus subscription program. Issued by Tesco Bank and backed by the Mastercard network, this card is aimed at UK residents looking for rewards on their everyday spending, interest-free purchase periods, and travel-friendly features.

In this article, you’ll find a complete breakdown of the card’s key features, benefits, drawbacks, and how to apply. If you’re a frequent Tesco shopper and want to maximise your Clubcard points while enjoying financial flexibility, this could be the ideal card for you.

Key features of the Tesco Clubcard Plus Credit Card

The Tesco Clubcard Plus Credit Card is considered a basic-tier credit card, making it accessible to a wide range of consumers with good credit history. As a Mastercard, it is widely accepted both in the UK and internationally. While the card doesn’t charge a separate annual fee, it requires an active Clubcard Plus subscription, which costs £7.99 per month.

Eligibility requirements

To be approved for the Tesco Clubcard Plus Credit Card, applicants must meet several criteria. You must be at least 18 years old, live in the UK or have a British Forces Post Office address, and have an annual income of at least £5,000. Additionally, you should not have applied for another Tesco Bank Credit Card within the last 30 days and must not hold more than one Tesco credit card at a time.

Benefits of the Tesco Clubcard Plus Credit Card

One of the main benefits of the Clubcard Plus Credit Card is its 0% interest on purchases for up to 24 months from account opening. Depending on individual circumstances, some applicants may be offered a 0% interest period of 20 or 16 months instead. This feature is particularly helpful for spreading the cost of large purchases over time.

Exclusive highlight

A distinctive advantage of this card is the ability to combine credit card points with Clubcard Plus rewards. This means Tesco shoppers can maximise savings and points accumulation within a single ecosystem. Moreover, the lack of foreign exchange fees is rare for a basic-level credit card, offering extra value to frequent travellers.

Drawbacks and considerations of the Tesco Clubcard Plus Credit Card

Despite its perks, the card has a few limitations. The most prominent is its relatively high representative APR of 37.7%, which factors in the £7.99 monthly subscription fee and the standard purchase rate of 19.9% p.a. This means that if you don’t take advantage of the 0% purchase period or miss payments, the card can become costly.

How to apply for the Tesco Clubcard Plus Credit Card

Applying for the Tesco Clubcard Plus Credit Card is a straightforward process. First, ensure you are an active Clubcard Plus subscriber. Then, gather the necessary documentation: your address history for the past three years, annual income details, take-home pay, and your current bank account and sort code.

The application can be completed online through the Tesco Bank website. After submitting your details, Tesco Bank will perform a credit check and, if approved, you’ll receive your card and credit limit based on your individual profile. Note that if you request a balance transfer during the application, you must activate the card within 60 days to complete the transfer.

Who is the Tesco Clubcard Plus Credit Card ideal for?

This card is best suited for existing Tesco Clubcard Plus subscribers who frequently shop at Tesco and want to get more value from their spending. It’s also a good choice for individuals planning large purchases they wish to pay off over time, thanks to the 0% interest window. Additionally, if you travel abroad occasionally and prefer not to pay foreign transaction fees, this card offers great convenience—provided the Clubcard Plus subscription remains active.