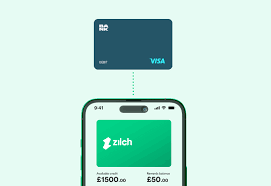

Navigating the credit landscape can be overwhelming, but Zilch Classic simplifies the process with its innovative and customer-friendly approach. Whether you’re looking to spread payments over time, earn rewards, or responsibly build your credit score, Zilch Classic offers the tools and flexibility to achieve your financial goals.

This credit card is designed for the modern consumer, with features that adapt to your lifestyle and needs. From flexible payment options to rewards for upfront payments, Zilch Classic ensures you’re in control of your spending. With an 18.6% APR Representative and no interest charges on purchases, this card is a standout option for anyone seeking a reliable and transparent credit experience.

Key information about the credit card

How does the annual fee work?

One of the most appealing aspects of Zilch Classic is its lack of an annual fee. This is not just a cost-saving feature but also a demonstration of Zilch’s commitment to providing value to its users. Many credit cards charge an annual fee that can range from modest amounts to significant sums, which may deter potential users. Zilch Classic removes this barrier entirely, making it an accessible option for individuals looking to simplify their finances.

The absence of an annual fee means that you can enjoy all the features of Zilch Classic without worrying about extra charges creeping into your budget. This is particularly beneficial for those who are new to credit or want to avoid unnecessary expenses while still reaping the benefits of a robust credit card offering.

How is the credit limit determined?

Zilch Classic offers a personalized credit limit tailored to your financial profile, ranging up to £2250. This limit is determined based on an assessment of factors such as your credit score, income, and repayment history. By evaluating these elements, Zilch ensures that the limit aligns with your financial capacity, promoting responsible borrowing.

For users who are new to credit or rebuilding their credit score, the limit may start on the lower end and increase over time with consistent and responsible usage. This dynamic approach helps users gradually build their financial trustworthiness while enjoying the flexibility of a higher limit as their circumstances improve.

Advantages of the credit card

- Flexible payment options: Choose from three ways to pay—spread payments over 6 weeks or 3 months, or pay upfront for rewards.

- Rewards program: Earn up to 5% cashback when you opt for upfront payment, adding value to your purchases.

- No interest fees: Enjoy peace of mind with interest-free purchases, reducing the financial burden associated with traditional credit cards.

- Snooze payments: Extend your payment deadlines by four or eight days when needed, giving you extra breathing room.

- Credit-building tools: Enhance your credit score with responsible usage. A dedicated in-app feature for tracking your score is coming soon.

- Automatic payments: Link your debit card to seamlessly handle repayments, ensuring you never miss a due date.

Standout advantage

The standout feature of Zilch Classic is its flexible payment structure combined with a rewarding system. Users can choose to pay upfront and earn up to 5% in rewards, which can be used to offset future purchases or saved for bigger rewards. Alternatively, for larger expenses, the card allows payments to be spread over six weeks or three months without incurring interest. This dual approach accommodates a wide range of financial needs, making it a versatile choice for consumers seeking both convenience and value.

Disadvantages

- Limited availability: Only available to UK residents aged 18 and above.

- Potential fees: Certain transactions or services, such as extended payment options, may incur additional costs.

- Eligibility requirements: Credit approval is subject to meeting specific financial criteria, which may limit accessibility for some users.

A standout disadvantage

The most significant drawback of Zilch Classic lies in its fee structure for certain optional features. For example, while the card itself is interest-free, fees may apply for services such as extending payment deadlines (using the “Snooze” feature) or for other specific transactions. These fees, while transparent, can add up for users who frequently rely on these features, making it essential to use the card wisely and budget accordingly.

Who can apply for this card?

Zilch Classic is available to individuals who meet specific eligibility requirements. Applicants must be at least 18 years old and reside in the United Kingdom. A stable income and a good credit history are typically required, as the card’s credit limit is tailored to your financial profile. While the card is designed to be inclusive, those with poor or no credit history may find it more challenging to qualify.

Additionally, applicants must provide valid identification documents and, in some cases, proof of income to support their application. This ensures that the card is issued responsibly, aligning with Zilch’s commitment to promoting financial well-being.

How to apply for the Zilch Classic Card

For the website

To apply online, visit the official Zilch website and navigate to the application section. The form will ask for basic personal details, including your name, contact information, and financial details. Once submitted, Zilch performs a quick credit check to evaluate your eligibility. This soft inquiry does not affect your credit score.

If approved, you’ll receive an offer detailing your credit limit and terms. The card will be mailed to your registered address within a few business days, and you can begin using it immediately upon activation. The website also provides comprehensive resources to guide you through the application process, ensuring a smooth experience.

Through the app

For those who prefer mobile solutions, the Zilch app offers a streamlined application process. Download the app from Google Play or the Apple App Store, create an account, and navigate to the “Apply” section. The app guides you step-by-step, making it easy to upload required documents, such as identification and proof of income.

The app also provides real-time updates on your application status, ensuring you’re always informed. Once approved, you can manage your card, track payments, and monitor your credit limit directly within the app. This digital-first approach is ideal for tech-savvy users seeking convenience and control.

At the branch

For a more personal touch, Zilch allows in-person applications at select branches. Bring your identification and proof of income to the branch, where a representative will assist you with the application. This method is especially beneficial if you have questions or require clarification about the card’s terms and features.

The branch experience ensures that all your concerns are addressed on the spot, providing peace of mind as you embark on your credit journey. Additionally, in-person applications may offer faster approvals, as representatives can verify documents immediately.