In today’s fast-paced financial landscape, managing and improving credit scores is crucial for unlocking better financial opportunities. Zilch Up stands out as an innovative option for those looking to build or repair their credit with a modern, user-friendly approach. Designed to cater to individuals with varying credit histories, it combines flexibility, transparency, and technology to redefine what a credit card can be.

With features like customizable credit limits, a straightforward repayment schedule, and built-in tools for responsible spending, Zilch Up aims to make credit-building both accessible and rewarding. But how does it truly measure up against the competition? This guide will take you through every detail you need to know about the Zilch Up card and how it can be an essential tool for your financial growth.

Key information about the credit card

How does the annual fee work?

One of the standout aspects of Zilch Up is its zero annual fee. This feature is significant, as many traditional credit cards charge yearly fees, which can be a financial burden, especially for those just starting their credit journey. By removing this cost, Zilch Up ensures that cardholders can focus on building their credit without worrying about additional expenses.

Unlike premium cards that justify their annual fees with exclusive perks like travel benefits or cashback rewards, Zilch Up prioritizes simplicity and accessibility. This approach makes it an excellent choice for individuals looking to manage their finances responsibly without being weighed down by hidden charges. The lack of an annual fee also demonstrates Zilch’s commitment to inclusivity, ensuring that users from all financial backgrounds can benefit from its services.

How is the credit limit determined?

Zilch Up offers a tailored approach to credit limits, with maximum limits set at £600. The institution assesses several factors to determine each applicant’s limit, including their financial history, banking activity, and repayment behavior. For individuals with limited or no credit history, Zilch Up leverages Open Banking technology to analyze income patterns and spending habits, creating a more inclusive and adaptive model.

As users build their credit profiles by making timely payments and responsibly using the card, they may qualify for higher credit limits. This incremental increase not only provides greater spending flexibility but also rewards users for maintaining good financial habits. The process is designed to ensure that limits align with the user’s ability to repay, promoting responsible borrowing and preventing financial strain.

Advantages of the credit card

- No interest or late fees: Unlike traditional credit cards that can accrue significant interest on unpaid balances, Zilch Up eliminates interest charges entirely. Similarly, there are no late fees for missed payments, making it a stress-free option for managing credit.

- Flexible repayment options: Users have the choice to pay upfront for rewards or split payments over six weeks or three months. This flexibility allows cardholders to manage their finances effectively while still enjoying the benefits of credit.

- Credit-building focus: Zilch Up actively helps users improve their credit scores by reporting to major credit bureaus. This is particularly valuable for individuals with low or no credit history, as it provides an opportunity to establish a positive credit profile.

- Snooze payments: This unique feature allows users to delay payments by 4 to 8 days without penalties. This flexibility is ideal for unexpected financial situations, providing users with peace of mind.

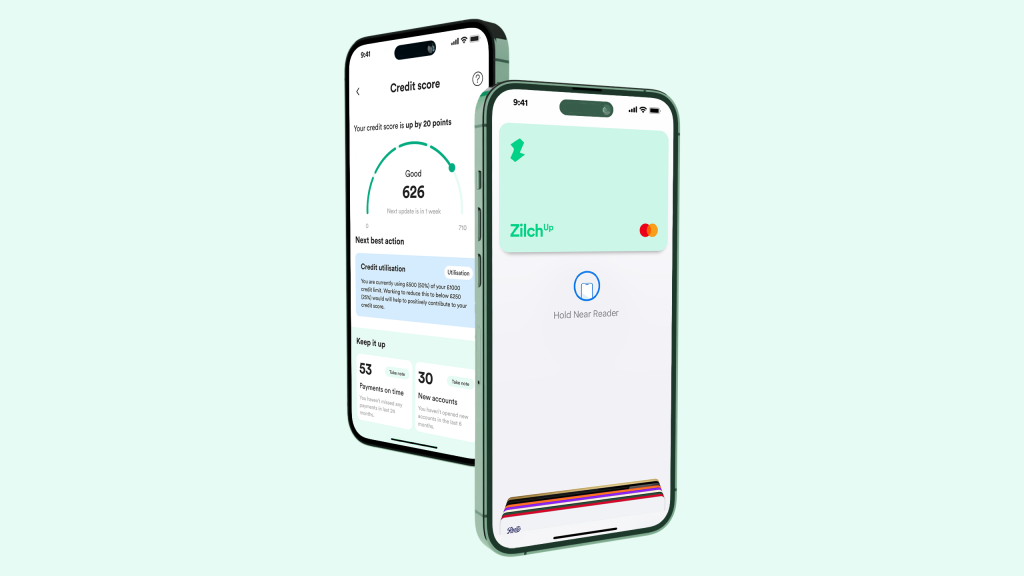

- In-app credit tools: The Zilch app includes features such as spending trackers and credit score monitoring (coming soon), empowering users to take control of their financial journey.

Standout advantage

The standout advantage of Zilch Up is its dedication to empowering users with low or limited credit scores. While traditional cards often rely solely on credit history, Zilch Up uses Open Banking technology to offer a fairer assessment of financial behavior. This approach opens doors for those who may have struggled to access credit in the past.

Disadvantages

- Low initial credit limit: The maximum limit of £600 may not be sufficient for users who require higher spending power. While the limit can increase over time, it starts relatively low compared to other credit cards.

- Fees may apply: Although Zilch Up avoids interest and late fees, certain transactions or features, such as payment extensions, may incur additional costs.

- Limited geographical availability: The card is currently only available to UK residents aged 18 and over, which may exclude some potential users.

A standout disadvantage

The most notable disadvantage of Zilch Up is its low initial credit limit. While this cap encourages responsible spending and prevents overborrowing, it may not meet the needs of individuals with larger financial obligations. Additionally, users who rely on credit for emergency expenses may find the limit restrictive, making it less suitable for those seeking higher purchasing power.

Who can apply for this card?

Zilch Up is designed for a wide range of users, including those with low credit scores or no credit history. To qualify, applicants must meet certain requirements, including being at least 18 years old, residing in the UK, and linking their accounts to Open Banking for assessment. There is no minimum income requirement, making the card accessible to students, part-time workers, and individuals rebuilding their financial profiles.

How to apply for the Zilch Up Card

For the website

To apply online, visit Zilch’s official website and navigate to the Zilch Up section. Click “Apply Now” and fill out the application form, providing your name, address, and financial details. You will need to connect your bank account via Open Banking for verification. This process allows Zilch to assess your income and spending habits to determine your credit limit. Once the application is complete, you’ll receive an instant decision, and approved users can begin using their digital card immediately.

Through the app

For a seamless and mobile-friendly experience, download the Zilch app from Google Play or the Apple Store. After creating an account, select the Zilch Up card option and follow the guided application process. This includes verifying your identity with a photo ID, linking your bank account, and customizing your credit preferences. The app also provides instant access to your card upon approval, allowing you to start using it right away.

At the branch

For those who prefer face-to-face assistance, Zilch partners with select retail locations where you can apply for the card. Visit a participating store, and a representative will guide you through the application process. Bring a valid ID and proof of address to ensure a smooth experience. Once your application is approved, you’ll gain access to your digital card and receive instructions on managing your account through the Zilch app.