Achieve Financial Independence Today: Get Your New Credit Card!

Do you want to take control of your financial journey? Great news! You may already be eligible for a new credit card that offers you countless opportunities. Here are the reasons why you should take advantage of this opportunity:

Benefits of Our Card Recommendation Service:

- ✅ Tailored to Your Needs

- ✅ Purchase Protection

- ✅ 100% FREE

Your credit score is like your financial GPA, and a strong credit score can open doors to opportunities you may not have even considered. By managing your credit card wisely—paying on time and keeping a low balance— you’re not just making purchases; you’re investing in your future. Whether you’re planning to take out a mortgage or an auto loan, a solid credit score is essential to achieving your dreams.

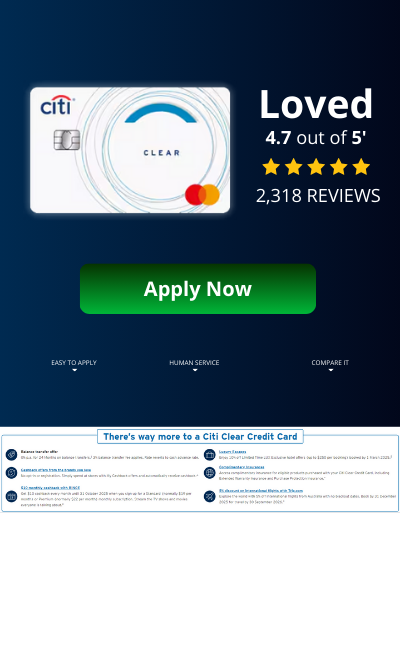

Getting started with credit cards may seem overwhelming, but rest assured—we are here to help, free of charge. Our team of financial specialists is committed to helping you find the ideal credit card that suits your specific needs and lifestyle. With extensive knowledge and industry expertise, we guide you to the best available options and help you make informed decisions throughout the process.

👉 Check below →

To avoid interest charges on your credit card balance, make sure to pay off the entire balance by the due date of each billing cycle. With this approach, you benefit from an interest-free grace period on new purchases. Additionally, some credit cards offer introductory 0% APR deals on purchases or balance transfers, allowing you to avoid interest payments for a certain period.

You can improve your credit score by using your credit card responsibly, such as making payments on time, keeping your credit utilization low, and avoiding excessive debt. Additionally, maintaining a mix of credit accounts and limiting new credit applications over time can also have a positive impact on your credit score.

Yes, paying your credit card bill early offers several benefits. It can lower your credit utilization ratio, which positively impacts your credit score. Early payments also help you save on interest costs, especially if you usually carry a balance. Furthermore, settling your bill ahead of time gives you peace of mind, knowing that your financial obligations are taken care of sooner.

In fact, there are several benefits to paying your credit card bill early. It can lower your credit utilization ratio, which has a positive impact on your credit score. Paying early also helps save on interest costs, especially if you normally carry a balance. Additionally, paying your bill early provides peace of mind that your financial obligations will be resolved sooner.

Don’t Miss This Opportunity!

Start your journey toward financial independence by applying for the credit card that’s waiting for you today. Our team is ready to support you at every step. By taking this important step, you can trust that our experts will guide you through the process and ensure that you choose the credit card that best fits your financial needs and lifestyle.

We want to help you make informed decisions, optimize your financial health, and set yourself up for success.

Apply now and unlock the potential of your financial future!